All the winners and losers from the 2023 spring Budget

Your spring Budget update – the key news from the chancellor’s statement

The Widening Gender Pension Gap

By Jessica Best

Without leading down a feminist tangent, we need to talk about the gender pension gap. For as long as women choose to have children, they will have smaller pensions than their male counterparts, as would any person who is the main child carer.

Commencing maternity leave, a mother would typically receive lower pay over the period which subsequently means fewer personal and employer pension contributions. The average woman sacrifices 5 years of her working life to raise children, which is a rewarding job in itself, however, during this time even more pension contributions will have been missed as well as the opportunity for career progression and subsequent pay rises that their male counterparts would have otherwise received.

Workplace pension contributions are the greatest benefit you can receive from your employer because it is effectively free money as a percentage of your salary, so stopping work to raise children unfortunately means you would be losing out on said contributions.

Personal pension contributions also benefit from automatic government tax relief, so again making these contributions you receive free money!

As per the age-old mantra of stocks and shares investments, making pension contributions early means they have the greatest opportunity to achieve long-term capital growth, of course you must remember this is not guaranteed.

One must also consider that women on average live 10 years’ longer than men, meaning they need larger pension pots to fund their retirement and any subsequent long-term care costs that may arise alongside.

What’s more, women are more likely to spend any income they do receive on their children, meaning they have minimal or no surplus income to put towards their retirement savings.

If you have a partner on parental leave or has reduced their work hours to raise your children, could you help them by making pension contributions on their behalf? Likewise, a pension contribution can be made at any age and you could commence a pension for a child or grandchild from birth to give their retirement savings a kick-start.

It is worth having these conversations now and understanding the importance of private pension provisions because the state pension will not provide enough for you to continue your current lifestyle in retirement and supporting female retirement provisions now gives them a chance to close their pension gap.

This article has been written as per current legislation of the 2022/2023 tax year.

Please note investments are not guaranteed, capital value can go down as well as up.

References: Phoenix Group and Insuring Women’s Futures, part of the Chartered Insurance Institute.

Explained: How pension tax relief works and boosts your retirement savings

Tax relief could boost your pension and mean you have more financial freedom in retirement. Yet it’s something that you may overlook when reviewing your pension, as analysis suggests that some workers aren’t claiming their full entitlement.

In fact, according to a report in The Telegraph, higher- and additional-rate taxpayers could have missed out on as much as £811 million of tax relief in the 2021/22 tax year.

So, how does pension tax relief work? Read on to find out.

Tax relief is like a bonus the government gives when you save for retirement

A pension provides a tax-efficient way to save for your future because of the tax relief you receive. Essentially, when you add money to your pension some of the money that would have gone to the government is added to your savings instead.

When you consider how this could add up over the long term, it means saving for retirement through a pension makes sense for two key reasons.

More money is going into your pension when you contribute so you could have a larger pot when you retire. As the money held in your pension is often invested, tax relief, along with other pension contributions, could grow further during your working life.

As saving into a pension is tax-efficient, contributing could reduce your overall tax liability. However, you should keep in mind that pension savings usually aren’t accessible until the age of 55, rising to 57 in 2028.

You receive tax relief at the highest rate of Income Tax you pay. The amount is calculated on your pre-tax earnings. So, as a basic-rate taxpayer, if you contribute £80 to your pension, you’ll receive £20 in tax relief, meaning a total contribution to your pension of £100.

To boost your pension by £100 in total, you’d need to contribute £60 and £55 as a higher- or additional-rate taxpayer respectively.

If you don’t earn more than the Personal Allowance, which is £12,570 for the 2022/23 tax year, you could still benefit from tax relief at a rate of 20%.

You may need to fill in a self-assessment tax return to claim your full entitlement

If you have a workplace pension, tax relief of 20% will usually be automatically added to your pension. This is known as “relief at source”.

However, if you have a different type of pension or you’re a higher- or additional-rate taxpayer, you will need to complete a self-assessment tax return to receive your full entitlement. You’d normally receive this additional tax relief through a tax rebate, which you can deposit into your pension if you choose.

It’s worth checking you’re receiving all the tax relief you’re entitled to, even if you believe it’s automatically added to ensure you’re not missing out. The Telegraph report indicates this is something many workers are overlooking.

How much tax relief can you claim?

If you can, contributing more to your pension could mean you receive more in tax relief so your money goes further.

There are limits to how much you can add to your pension before you could face an additional tax charge when you access your savings. These thresholds include the:

Annual Allowance: This is the amount you can add to a pension during a tax year while still retaining the benefits of tax relief. For the 2023/24 tax year, the Annual Allowance is up to £40,000 or 100% of your annual earnings, whichever is lower. There are circumstances when your Annual Allowance may be lower, including if you’re a high earner or have already taken an income from your pension. Please contact us if you have any questions about the Annual Allowance.

Lifetime Allowance: The Lifetime Allowance is the total pension benefits you can build up before suffering a tax charge. It covers the total value of your pension, rather than just your contributions, so you may also need to consider how tax relief, employer contributions, and investment returns will add up. For the 2023/24 tax year, the Lifetime Allowance is £1,073,100. The government has frozen the Lifetime Allowance until 2025/26.

Pensions can be confusing and you may not be sure if you’re saving enough for the retirement you want. Contact us to talk about your long-term goals and the steps you could take now to help you reach them.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Premium Bonds prize rate hits 15-year high, but are they worth it?

There are now more chances to win through Premium Bonds as the prize rate reaches a 15-year high. So, what are your odds of becoming a millionaire overnight and are they worth it? Read on to find out.

Premium Bonds were first introduced in 1956 to encourage more people to save. They’re issued by National Savings and Investments (NS&I) and backed by the government. However, they’re different to traditional savings accounts or bonds.

While Premium Bonds offer an “interest rate” of 3.3% as of March 2023, it’s not paid in the same way as a savings account.

Instead, each bond is entered into a prize draw each month, with ERNIE (the Electronic Random Number Indicator Equipment) selecting the winners. It means you could win up to £1 million, but on the flip side, your savings may not earn anything at all.

You can buy Premium Bonds for just £25 up to a maximum of £50,000. Each bond you hold has 24,000 to 1 odds of winning, with prizes ranging from £25 to £1 million.

You can also purchase Premium Bonds on behalf of children.

Premium Bonds have proved a popular way to save. In fact, more than 22 million people have more than £119 billion saved in them.

So, should you make Premium Bonds part of your financial plan? As with any financial opportunity, there are pros and cons, and whether it’s right for you will depend on your goals.

4 reasons why people use Premium Bonds to save

1. You could become a millionaire!

One of the biggest draws of Premium Bonds is the chance to become a millionaire overnight – each month two Premium Bond holders win £1 million. Everyone loves the idea of winning big, so it’s easy to see why Premium Bonds are attractive to some people.

2. Your savings are risk-free

HM Treasury backs Premium Bonds, so there’s no risk of losing the money you use to buy them. As a result, Premium Bonds could fit into your overall financial plan.

This point used to be key, but since the introduction of the Financial Services Compensation Scheme (FSCS), all UK savings are protected up to £85,000 per person, per institution the savings are held with.

3. Your money is instantly accessible

You can withdraw money held in Premium Bonds instantly, without facing any charges. So, if you’re saving for short-term goals or building up an emergency fund, Premium Bonds could be a useful option to consider.

4. The prizes are tax-free

If you’re lucky enough to win a prize through Premium Bonds, the money is tax-free.

If you don’t have the maximum £50,000 in Premium Bonds, there’s an option to automatically purchase more to increase your chances of winning again in the future.

2 key drawbacks you need to know before using Premium Bonds

1. There’s no guarantee that you’ll win

With a traditional savings account, you know how much interest you’ll receive on your deposits. This isn’t the case with Premium Bonds – if you’re unlucky, you could go years without winning.

In fact, according to Money Saving Expert, around 60% of people that hold £1,000 in Premium Bonds don’t win a prize at all each year.

You need to weigh the excitement of potentially winning big against the reality that you could receive far less than you would if you place the money in a savings account.

2. Your money could be losing value when you consider inflation

While your money is secure in Premium Bonds, once you consider inflation, the value could be falling in real terms.

This is because the prizes you win are unlikely to keep pace with inflation. So, over the long term, your savings will gradually buy less. This isn’t just an issue for Premium Bonds, but something most people that are holding money in cash need to consider.

If you’re saving with long-term goals in mind, investing could help your savings grow at a pace that matches or exceeds inflation. However, investing comes with risks and you cannot guarantee returns. As a result, you’ll need to consider what your risk profile is and whether investing is right for your goals.

If you have questions about how Premium Bonds could fit into your financial plan and support other steps you are taking, please contact us. We’ll help you understand if Premium Bonds could be appropriate for you, as well as look at the alternatives.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

5 inaccurate expert predictions that prove why you shouldn’t try to time the market

When you look at investment performance with the benefit of hindsight, you may think you could predict how markets will move. Yet, markets are unpredictable and expert forecasts prove how difficult timing the market is.

Every investor has heard the advice “buy low, sell high”. So, it can be tempting to try and guess how investments will perform in the short term to make the most of your money. But history shows us that trying to time the market is impossible.

Even experts who have far more resources at their disposal sometimes get it wrong, so trying to predict the market and economy could mean you miss out. Here are five examples of when expert predictions completely missed their mark.

1. 1929: The market has reached a “permanently high plateau”

Irving Fisher is considered one of America’s greatest mathematical economists. But his name is still linked to a major incorrect prediction – in 1929, he claimed that stock markets had reached a “permanently high plateau”.

Just nine days later, the “Great Crash” occurred and led to the collapse of the New York Stock Exchange. In a single day (29 October 1929), investors traded some 16 million shares, making it the largest sell-off of shares in US history and investors lost billions of dollars. The crash signalled the start of the Great Depression.

2. 1995: The internet will “catastrophically collapse”

When you’re considering investing in new industries, expert advice can be invaluable. However, basing your investment strategy on predictions could mean you miss out on opportunities.

In 1995, Robert Metcalfe, the co-inventor of the Ethernet, gave a magazine interview where he said the internet would “soon go spectacularly supernova” and in 1996 “catastrophically collapse”. He was so confident, he promised to eat his words if he was wrong.

Of course, almost three decades later, we know that wasn’t the case. The internet has become an integral part of everyday life and business operations. Metcalfe stuck to his word though – he blended the magazine and literally ate his words in front of a live audience.

3. 1999: Stock values will soar fourfold

Just before the turn of the millennium, two experts, James Glassman and Kevin Hassett, published a book that claimed stocks in 1999 were significantly undervalued. As a result, investors could benefit from a huge rise in value over the next few years, they said.

In fact, they predicted the value of stocks would increase fourfold and the Dow Jones Industrial Average would increase to 36,000 by 2002 or 2004.

Just two years later, the dotcom bubble meant the stock market fell sharply. Other factors, including the 2008 financial crisis, meant that the Dow didn’t reach the 36,000 milestone until 2021.

4. 2007: The subprime mortgage market troubles are “largely contained”

Many investors will remember the effects of the 2008 financial crisis, which was partly caused by the subprime mortgage market in the US. Looking back, it can seem like all the signs of impending trouble were there, yet many experts failed to connect the dots.

Former US treasury secretary Hank Paulson said the subprime mortgage market would be “largely contained” and he didn’t see it causing a “serious problem” in 2007. He wasn’t the only expert to downplay the risks either. Others agreed, and some even suggested that it presented an opportunity.

The problem turned out to be far-reaching – it triggered a global recession, markets fell in value, and governments had to bail out financial institutions.

5. 2021: Inflation will peak at around 5%

As it considered the lasting effects of the Covid-19 pandemic in November 2021, the Bank of England (BoE) predicted that inflation would be around 5% in spring 2022 and that the period of high inflation would be temporary.

Just months later, the war in Ukraine meant that oil and gas prices were much higher than anticipated. Other factors also affected the cost of living, which was high for much of 2022. Inflation reached 11.1% in the 12 months to October 2022 and remained well above the BoE’s 2% target at the start of 2023.

How time in the market could help you overcome volatility

The five examples above highlight how difficult it is to time the market. While you may base your prediction on information available at the time, there are so many factors that could affect how the market moves that are outside of your control. As a result, trying to time the market could mean you miss out on growth opportunities.

For most investors, a long-term investment strategy focused on time in the market makes sense. Rather than buying and selling frequently, creating a portfolio that reflects your goals and risk profile could help you build long-term growth. While markets do fall, and so can the value of your investments, historically, markets have recovered from dips and delivered growth over a longer time frame.

It can be difficult to ignore the noise when you’re investing and you may be tempted to make changes. However, looking at the value of your investments over years, rather than days or weeks, is important. Remember, time in the market, rather than timing the market, could deliver long-term value.

If you have any questions about your investment strategy or which opportunities could be right for you, please get in touch.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Soaring inflation drives up retirement costs by almost 20% in just a year

High inflation means retirees could need to increase their budget by almost 20% to maintain the same lifestyle, research suggests. If you’re drawing an income from your pension, it’s vital you understand whether withdrawing more is sustainable.

The UK experienced high inflation throughout much of 2022, and inflation remains above the Bank of England’s target of 2%. This has stretched many household budgets, but retirees may find it more difficult to weather a period of high inflation.

As your income may not increase, or you deplete assets more quickly, you could face more financial uncertainty later in life.

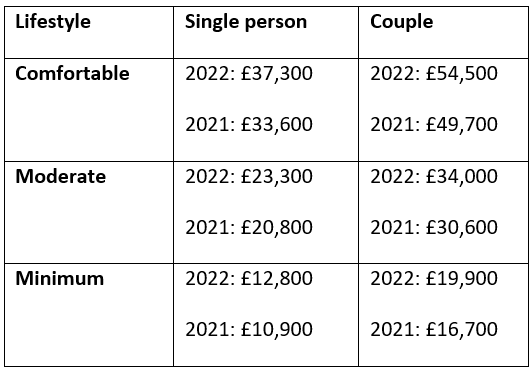

A retired couple needs an annual income of £34,000 for a “moderate” lifestyle

The Pensions and Lifetime Savings Association (PLSA) has updated its Retirement Living Standards to reflect recent high inflation. It found that some retirees will need to increase their budget by 19% just to maintain the same standard of living they enjoyed at the start of 2022.

The organisation noted that people that retired with a lower income have seen the biggest percentage increase because a higher proportion of their budget goes towards areas that have risen the most, such as food and energy.

The PLSA research sets out the annual income retirees may need to secure a “minimum”, “moderate”, or “comfortable” lifestyle.

The “minimum” lifestyle covers things retirees need to live a fulfilling life, including social and cultural participation. For a couple, this includes £96 a week for grocery shopping, a week-long break in the UK, and affordable leisure activities twice a week. It also considers things like maintaining a property.

In the space of just a year, the cost of a minimum lifestyle has increased by 19% for a couple.

The “comfortable” lifestyle budget includes more luxuries, such as running two cars and three weeks visiting Europe each year.

For a two-person household, the cost of this lifestyle has increased by 10% in the last year.

The table below shows the PLSA’s estimated income needs for each lifestyle and how the period of high inflation has affected budgets.

Keep in mind that these figures are a useful indicator of retirement costs, but your outgoings will depend on your lifestyle. However, it does highlight why reviewing your pension and income is so important.

If you’ve already retired, you should look at whether you could use your assets to boost your income, while being mindful of ensuring you don’t run out of money during your lifetime.

4 things to consider if you’re reviewing your retirement income

If high inflation means you need to review your retirement income, these four questions could help you understand your options.

1. How much have your outgoings increased?

First, take some time to look at how your expenses have changed in the last year. While the official inflation figures can be useful, your personal inflation rate may be very different. It will depend on how you spend your money and your priorities. So, going through your budget could help you identify a potential shortfall.

2. What reliable income do you have?

In retirement, you may have several sources that you can rely on to pay an income for the rest of your life. This may include the State Pension, an annuity, or a defined benefit (DB) pension.

In some cases, the income provided will rise in line with inflation to protect your spending power. For example, the State Pension will rise by a record 10.1% in April 2023. As a result, your income gap may not be as large as you first think.

3. What other assets could you use to increase your income?

Next, review your other assets that could provide an income in retirement. This could include a flexible income from a defined contribution (DC) pension. You may also have other assets you could use, such as investments, savings, or property.

Reviewing these assets could help you bridge a potential gap if inflation means you’re facing a shortfall.

4. Could you sustainably increase your income?

Remember to look at your overall financial plan and consider the long term when making decisions.

While other assets could boost your income, don’t forget to consider whether using these assets is sustainable over the long term.

So, while you could increase how much you withdraw from your DC pension, could it mean you run out of money later in life? And how would taking an income from investments affect your portfolio’s performance?

Contact us to create a retirement plan

As financial planners, we can work with you to create a retirement plan that suits you. We’ll consider what type of lifestyle you want throughout retirement and how you could use your assets to help you achieve it. We’ll also factor in potential risks, such as a period of high inflation, so you can have peace of mind about your retirement finances.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.