Rishi Sunak is reportedly drawing up plans to provide a “midlife MOT” to assess the financial health of workers and retirees. Taking stock of your finances in your 40s and 50s could lead to greater financial freedom in the future. Read on to discover five initial steps you can take to review your wealth.

Sunak’s plans are focused on encouraging people to get back to work as employment figures are still not back to the levels they were before the Covid-19 pandemic. Early retirees that gave up work during the pandemic are now feared to be hampering the UK’s economic recovery.

There are also concerns that some early retirees made the decision based on assumptions about their finances before the cost of living crisis. Over the last year, inflation has been high and it could mean some retirees face a financial shortfall now or in the future.

While Sunak’s plans are designed to encourage more people to join the workforce, a midlife MOT can be useful for keeping your plans on track.

Your mid years are often crucial for building wealth that could mean you are financially secure in the future. So, taking stock now is a worthwhile task.

Here are five areas you should cover in your financial midlife MOT.

1. Review outstanding debt

Reducing your expenses as you near retirement could provide far more financial freedom. One key way of doing this is to create a plan to reduce outstanding debt.

One of the largest debts you have is likely to be your mortgage. If you can, a plan to own your home outright when you retire can significantly reduce the income you need. Paying off credit cards or loans could also boost your disposable income in the future.

Having debt, including a mortgage, doesn’t mean you can’t retire, but you should factor repayments into your budget when assessing the income you need.

2. Assess your savings

Spend some time assessing your savings and understand if they would provide a safety net if you faced a financial shock, like an unexpected property maintenance bill or being unable to work due to an illness.

Having savings to fall back on when you need them can provide vital financial security now and in the long term. It means you could weather financial shocks and you don’t have to dip into other assets that you earmarked for other goals.

As the Bank of England has increased interest rates, it’s worth shopping around to see if you’re getting the most out of your money.

3. Look at your investment portfolio

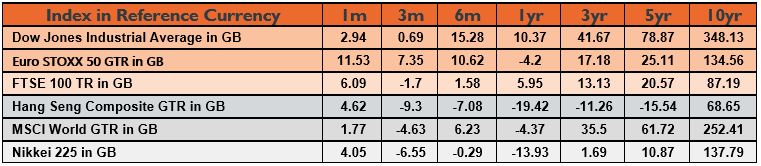

Regularly reviewing your investment portfolio can help you understand how it’s performing – remember to review returns with a long-term view, rather than focusing on how the value of investments have changed over weeks or months.

It’s also a good opportunity to ensure your portfolio continues to reflect your goals. Changes to your circumstances or aspirations could mean adjustments to your investments make sense.

If investing isn’t something you’re already doing, it could help you reach long-term goals.

While investing does involve risk and the value of investments can fall, historically, markets have delivered returns over longer time frames. So, if you’re saving for a goal that is more than five years away, investing could grow your wealth and help your assets keep pace with inflation.

When you invest, it’s essential you consider the level of risk that’s appropriate for you and your circumstances.

4. Set out your retirement plans

When you think about retirement planning, it may be finances and pensions that come to mind. However, when and how you want to retire are crucial pieces of information if you’re to create a reliable retirement plan.

Set out what your retirement plans are – do you want to phase into retirement by working part-time? Or are you hoping to retire early?

You should also consider what you want your lifestyle to look like when you give up work. This can be useful for understanding the income you need your pension and other assets to deliver to reach your goal.

5. Check if you’re on track to reach your pension goal

With a clearer understanding of your retirement plans, you can review your pension – are you on track to have enough to live the retirement lifestyle you want?

It can be difficult to understand how the value of your pension will change between now and retirement, and what the value needs to be to provide financial security. As well as considering what contributions you’ll make, you may also need to consider things like investment returns. So, working with a financial planner here can be valuable.

Going through your pension now could uncover potential gaps and provide an opportunity to fill them.

A financial review can help you take stock of where your finances are now and the steps you could take to reach your goals. Please contact us to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.