McLaren Insights

Investors should expect further volatility in the markets in 2023, experts suggest.

Economies around the world are facing recession due to factors including high inflation and rising interest rates. The International Monetary Fund’s Kristalina Georgieva predicts that a third of the global economy will be in recession this year.

The World Bank also has a similar outlook, as it cut its global growth forecast from 3% to 1.7% after risks identified six months ago materialised. The organisation warned that fresh setbacks could lead to the second global recession in three years.

As an investor, remember that volatility in the markets is normal. Take a long-term view of your portfolio’s performance and focus on your overall goals rather than short-term market movements.

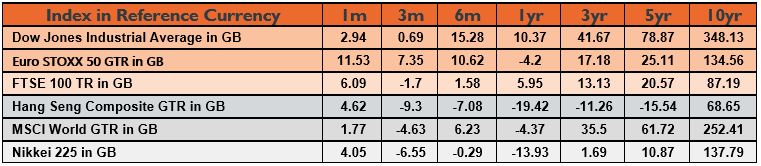

Here are some of the factors that affected markets in January 2023.

UK Financial News

There was a positive sign that the UK could avoid the long recession that some experts have predicted – the economy grew by 0.1% in November.

The UK inflation rate also dipped slightly to 10.5% in the 12 months to December. It suggests that inflation is starting to ease, but it’s still far higher than the Bank of England’s (BoE) target of 2%. However, the BoE’s chief economist Huw Pill warned that the UK could face persistent challenges if domestically generated inflation gained momentum. For example, if firms try to maintain real profit margins, it could prolong the high inflation environment.

High energy prices in particular continue to be a challenge for both households and businesses. Chancellor Jeremy Hunt will slash the current energy support scheme for businesses in March. He told business leaders that the current scheme is “unsustainably expensive”. Trade body MakeUK, which represents around 20,000 manufacturers, criticised the news. It warned that two-thirds of businesses expect to cut production or jobs as a result of energy prices.

The UK government’s borrowing reached a record high in December, which highlights the cost of the energy support scheme. The government borrowed £27.4 billion, the highest amount recorded since records began in 1993. The high figure was linked to the cost of energy and interest rates rising. The figure was £9.8 billion more than the Office for Budget Responsibility forecast, potentially leaving little room for Hunt to cut taxes in the upcoming spring Budget.

According to the Office for National Statistics (ONS), industrial action also affected firms, with a quarter of businesses said they were unable to obtain the necessary goods for their operations during the month. The ONS data suggests that some businesses plan to make cuts to their staff in the next three months. 5% say they could make redundancies, while two-thirds plan to take action to cut staff costs. Yet, the figures also show that a third of businesses are experiencing a shortage of workers.

Readings from the S&P Global Purchasing Managers’ Index (PMI) indicate that sectors are struggling. A reading below 50 indicates contraction.

The manufacturing sector ended 2022 in a downturn, with a reading of 45.3. It’s the fifth consecutive month of decline.

A fall in new orders affected the service sector, but only marginally, with a reading of 49.4.

The ONS has warned that some households could face a significant rise in their outgoings. In 2023, 1.4 million fixed-rate mortgage deals will end, and many of them have an interest rate below 2%. As interest rates climbed throughout 2022, this means homeowners could face a much larger mortgage bill than they expect when their current deal ends.

Figures from the BoE also show that consumers are borrowing more to cope with the rising cost of living. £1.5 billion was borrowed in November. Most of this, around £1.2 billion, was on credit cards and was the highest figure recorded since 2004.

European Financial News

Inflation in Europe could be stabilising. In Germany, the figure for the 12 months to December 2022 fell to 8.6% from 10% a month earlier. However, food prices (20.7%) and energy costs (24.4%) are still much higher than a year ago.

The PMI data suggests the construction sector in the eurozone is suffering a “sustained contraction” after the reading fell to 42.6. All three of the largest economies the survey covers in the eurozone – Germany, France, and Italy – suffered a drop.

Total output is still in the contraction territory, but it is easing with a reading of 49.3, and the service sector moved back into growth with a reading of 50.2.

While still challenging, the pressure easing is reflected in a survey from the Ifo Institute. It found that German business morale is up as the economic outlook improves.

Unemployment figures from the eurozone also indicate that businesses are feeling confident about their prospects. Eurostat reported that unemployment remained at a record low of 6.5% in November.

US Financial News

There are positive signs for the US economy – inflation fell and the number of jobs increased. In the 12 months to December 2022, US inflation fell to 6.5%. It indicates that the cost of living pressures are starting to ease. The US job market ended 2022 on a high. The Department of Labor reported that 223,000 jobs were added to the economy at the end of the year. Unemployment also fell to 3.5%, taking it to its pre-pandemic low. Yet, some businesses are still struggling. The PMI for the factory sector suggests it suffered its fastest rate of decline since May 2020, with a reading of 46.2.

Unsure about your investment portfolio? Why don’t you get in touch with one of our financial advisers for a consultation on us.

Would you like to receive McLaren’s monthly market insights directly to your inbox? Sign up below.